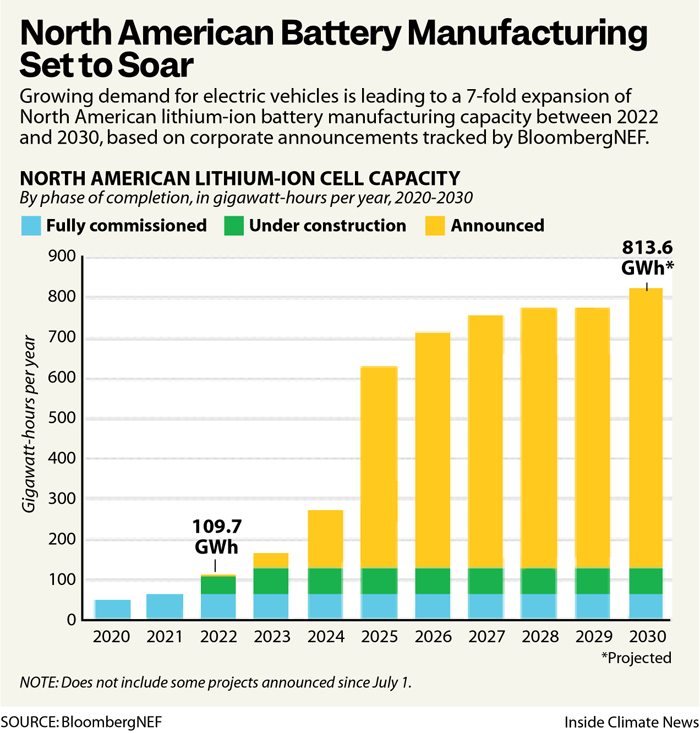

The sales of electric vehicles in the US are rapidly accelerating. Despite their current modest slice of the auto market, the extraordinary valuations of industry giants such as Tesla provide a snapshot of the potential of an almost budding market. The US intends to escalate domestic battery production to further reduce costs and allure customers over the next ten years.

Image credit: insideclimatenew

But with international competitors already ahead in technology and resources, can the US catch up in the EV battery market?

The conventional lithium-ion EV battery relies on a cathode composed of nickel, cobalt, and manganese (NCM) to provide longer range and faster charging capabilities. However, these batteries can be prone to overheating and fire hazards.

Moreover, the global supply chain for nickel and cobalt is often associated with human rights abuses due to its reliance on countries like Russia and the Democratic Republic of the Congo.

Researchers have been exploring an alternative cathode material known as lithium-iron-phosphate (LFP) to address these concerns. LFP batteries offer greater stability and lower costs compared to NCM batteries.

However, they have historically fallen short in energy density, requiring more space for equivalent ranges. Striking the right balance between size and range has been a key challenge hindering LFP’s competitiveness against NCM. Despite these challenges, progress has been made.

9 for a Kentucky-based plant.

Tesla introduced LFP batteries into its U.S. lineup last year, signaling their viability. Now Ford is following suit by announcing plans to build a new $3.5 billion EV battery factory in Michigan dedicated solely to manufacturing LFP batteries.

Ford’s upcoming facility called “BlueOval Battery Park Michigan” is expected to employ 2,500 people when production of LFP batteries commences in 2026, according to the company’s statement released on Monday.

While this new EV battery will not immediately replace conventional NCM batteries across all Ford electric vehicles, it represents an important step towards diversifying its battery portfolio. Ford intends to continue using NCM and LFP formulas as part of its strategy to sell 2 million electric vehicles globally by the end of 2026.

General Motors (GM), one of the oldest and most established automakers in the United States, has also recognized the importance of battery production. In 2019, GM announced plans to build an electric vehicle battery plant in Ohio through a joint venture with LG Chem called Ultium Cells LLC.

The new facility is expected to have an annual capacity of over 30 gigawatt-hours (GWh) and produce advanced lithium-ion batteries for GM’s upcoming electric vehicles. This move signifies GM’s commitment to developing its batteries rather than relying solely on external suppliers.

GM aims to reduce reliance on international supply chains by producing their batteries and gaining more control over costs and quality. Furthermore, this strategic partnership with LG Chem allows them access to advanced battery technologies developed by one of the world’s leading manufacturers.

Recently, Hyundai disclosed plans to allocate $5.5 billion towards an electric vehicle and battery facility in Georgia. In the same vein, SAW Stellantis and Samsung revealed their plan to establish a $2.5 billion facility in Indiana.