In a stunning turn of events, China’s BYD has dethroned Tesla as the world’s largest electric vehicle (EV) manufacturer in the final quarter of 2023. The Chinese giant recorded an unprecedented sale of 525,409 battery electric vehicles (BEVs) in just three months leading up to December 31, edging out Tesla’s impressive 484,507 deliveries.

Despite Tesla’s annual sales still surpassing BYD with 1.8 million electric cars compared to BYD’s 1.57 million, the margin of dominance has significantly decreased. In 2023, the gap between the two was a mere 230,000 units, a substantial reduction from 2022’s 400,000. This shift signifies the burgeoning might of China’s EV sector, propelled by robust governmental support and a keen focus on sustainability and innovation.

China’s EV revolution is rapidly accelerating, with a firm target that by 2025, at least 20% of new car sales should be new energy vehicles (NEVs), encompassing BEVs, plug-in hybrids, and hydrogen fuel cell vehicles. The goal is to make NEVs the mainstream by 2035. Impressively, the country achieved its first milestone three years ahead of schedule in 2022, and it’s expected to reach the next one much earlier than anticipated.

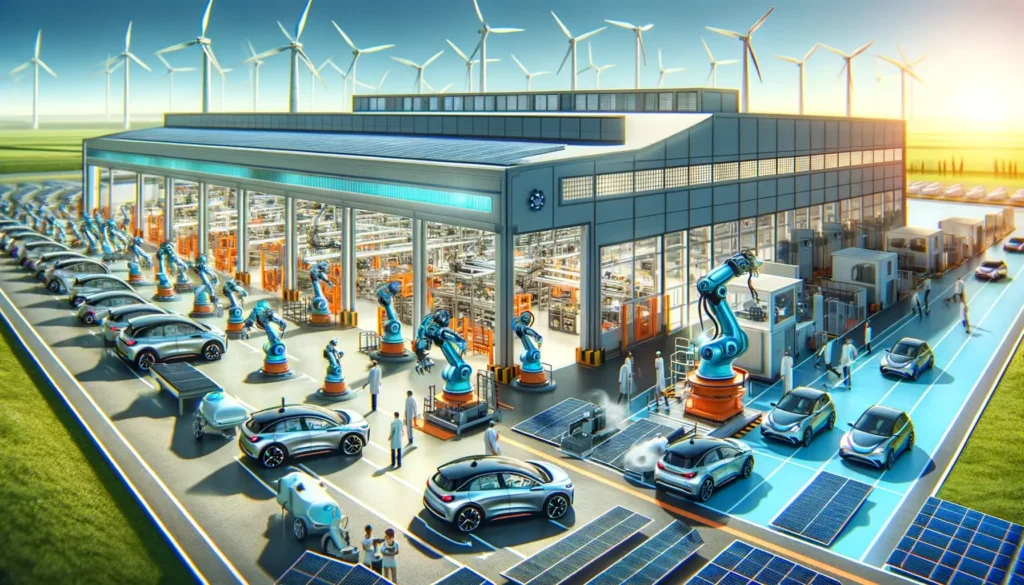

Analysts credit China’s leading position in the global EV market to its vast market scale, cost-effective labor, and dominance in the supply chain. With significant governmental backing through infrastructure investments and subsidies, Chinese EV manufacturers have found it easier to expand both domestically and internationally.

However, the industry is not without its challenges. Intense competition and a brutal price war in the previous year have squeezed profit margins. The industry-wide profitability in China dropped to just 5% for the first 11 months of the last year, a decline from the previous years. In response to the slowing domestic market, Tesla initiated a price cut in January, igniting a price war to retain competitiveness.

To counteract domestic market saturation, Chinese car manufacturers are venturing abroad, particularly focusing on Europe, Australia, and Southeast Asia. BYD’s ambitious move to double its dealer partners in Europe and its plans to construct an EV factory in Hungary exemplify this strategic expansion.