The electric vehicle (EV) market in the United States is undergoing significant growth, driven by environmental awareness and government incentives. In the pursuit of President Biden’s goal of achieving 50% of all new vehicle sales as electric by 2030, the EV market has witnessed substantial expansion, with more than 800,000 EVs sold in 2022 alone. However, the EV landscape varies across states, and choosing where to buy an EV can significantly impact the incentives, rebates, and overall experience for prospective buyers.

The Best States for Buying EVs

- Colorado: A Beacon for EV Enthusiasts

Colorado has emerged as a shining example of a state that welcomes EV buyers. The Centennial State boasts a plethora of incentives, making it an attractive destination for electric vehicle enthusiasts. The state’s vehicle exchange program offers substantial on-the-spot discounts, with up to $6,000 available for plug-in hybrid electric vehicles (PHEVs) like the Jeep Wrangler.

Furthermore, additional federal tax credits can slash an additional $3,750 from the purchase price. Starting in 2024, buyers can enjoy discounts of up to $13,500 for battery-powered electric vehicles (BEVs). In total, Colorado’s EV incentives can amount to a staggering $12,500, making it an EV enthusiast’s paradise.

- California: Pioneering the EV Movement

California has long been a trailblazer in the EV revolution, offering a combination of state and federal tax credits that significantly reduce the upfront cost of electric vehicles. Though the funds for state rebates may need to be higher due to high demand, California remains a shining example of how a state can incentivize EV adoption. With a market share of approximately 25%, California is a leader in electric vehicle sales.

- Vermont: Generous Rebates and Support

Vermont provides substantial rebates for EV buyers, making it an attractive destination for those looking to make environmentally conscious choices. The state has approved over 800 rebate applications in the past year, with average rebates amounting to $3,070.

Whether you’re interested in a pure electric vehicle or a plug-in hybrid, Vermont’s rebate program can help you make a more sustainable choice. Single filers with varying income levels can receive rebates, capped at a base Manufacturer’s Suggested Retail Price (MSRP) of $50,000.

- Washington

Washington state is known for its commitment to clean energy and sustainability. It offers a sales tax exemption on purchasing new electric vehicles, saving buyers thousands of dollars. In addition, Washington has a robust charging infrastructure, making it convenient for EV owners to charge their vehicles. The state’s dedication to renewable energy and EV adoption contributes to its favorable environment for purchasing electric cars.

- New York

New York has implemented several incentives to encourage EV adoption. The state offers a rebate of up to $2,000 for the purchase or lease of an all-electric vehicle or plug-in hybrid electric vehicle. Additionally, New York has invested in charging infrastructure, with a network of public charging stations available throughout the state. These initiatives make New York an appealing option for EV buyers.

The Worst States for Buying EVs

- Texas: A Challenging Environment for EV Buyers

Texas may not be the most welcoming state for EV buyers due to its annual fee for electric vehicles, which can range from $50 to $225. The state justifies these fees by using gas tax revenue to fund road infrastructure, which could be problematic for drivers who no longer purchase gasoline. Texas also imposes a $200 annual fee on EV owners, and new buyers are subject to a $400 first-time registration fee.

- North Dakota: Lagging Behind in EV Adoption

North Dakota has one of the lowest electric vehicle market shares, with only 1.2% of new vehicles being electric. The lack of incentives, coupled with limited charging infrastructure, has deterred many residents from switching to electric vehicles. The state’s policies and lack of support have resulted in slow EV adoption.

- Wyoming

Wyoming, another state with low EV adoption rates, offers limited incentives for EV buyers. The lack of state tax credits or rebates, coupled with the absence of a comprehensive charging infrastructure, makes Wyoming one of the least favorable states for purchasing EVs.

- Mississippi

Mississippi needs to be faster to adopt policies that promote electric vehicle ownership. The state does not offer any significant incentives or tax credits for EV buyers. Additionally, the charging infrastructure in Mississippi is minimal, making it challenging for EV owners to find convenient charging stations. These factors contribute to Mississippi’s ranking as one of the worst states to buy EVs.

- West Virginia

West Virginia also needs more incentives and policies to encourage EV adoption. The state’s limited charging infrastructure and the absence of state tax credits or rebates make it less attractive for EV buyers. Without robust government support, West Virginia falls behind other states in terms of electric vehicle accessibility and affordability.

The Evolving Landscape of Electric Vehicles

The electric vehicle market is rapidly evolving, with ambitious goals set by the White House in 2021. President Biden’s vision aims to see half of all new vehicle sales become electric by 2030. While the current market share of electric vehicles in the United States stands at around 8%, electric vehicle sales are expected to skyrocket, and Goldman Sachs suggests that the White House goal is attainable.

In 2022, more than 800,000 electric vehicles were sold, up from 488,000 in 2021. The third quarter of the same year witnessed a remarkable record, with over 300,000 new electric vehicles sold, according to Cox Automotive. However, it’s essential to acknowledge that electric cars often have a higher price tag than their gas-powered counterparts. On average, an electric car costs $53,469 for new ones, while gas-powered vehicles come in at $48,334, according to data from July 2023.

Navigating Federal Tax Credits

Under the Inflation Reduction Act, a federal tax credit of up to $7,500 is available for electric vehicle buyers. To qualify for the full credit, cars must meet specific battery and critical mineral requirements. The battery requirement mandates specific percentages of battery components manufactured or assembled in North America. In 2023, this percentage stands at 50%, increasing to 60% in 2024 and 2025. This means 60% of your EV’s battery components must be manufactured or assembled in North America.

The critical mineral requirement includes lithium, nickel, cobalt, manganese, and graphite. If your EV meets only one of these requirements, you can still receive a $3,750 credit. Additionally, the tax credit is restricted to vehicles that undergo final assembly in North America and is at most $80,000 for vans, SUVs, or pickup trucks or $50,000 for other vehicles. Certain income thresholds apply, with joint filers limited to $300,000, heads of households capped at $225,000, and other taxpayers restricted to $150,000.

Closing the Price Gap

Buyers who can combine federal and state benefits discover that the price gap between electric and gas-powered vehicles has significantly narrowed. For instance, if a 2023 Tesla Model 3 is priced at $40,240, subtracting $5,000 from Colorado’s incentive and $7,500 from the federal government results in an electric vehicle cost of $27,740, according to Atlas’s analysis.

This is only $1,420 more than the cost of a 2023 Toyota Camry, making the choice for an electric vehicle more financially attractive. Moreover, an analysis from Consumer Reports suggests that electric vehicle drivers can save anywhere from $6,000 to $12,000 compared to gas-powered cars over a vehicle’s lifetime due to the lower costs of powering their electric vehicles.

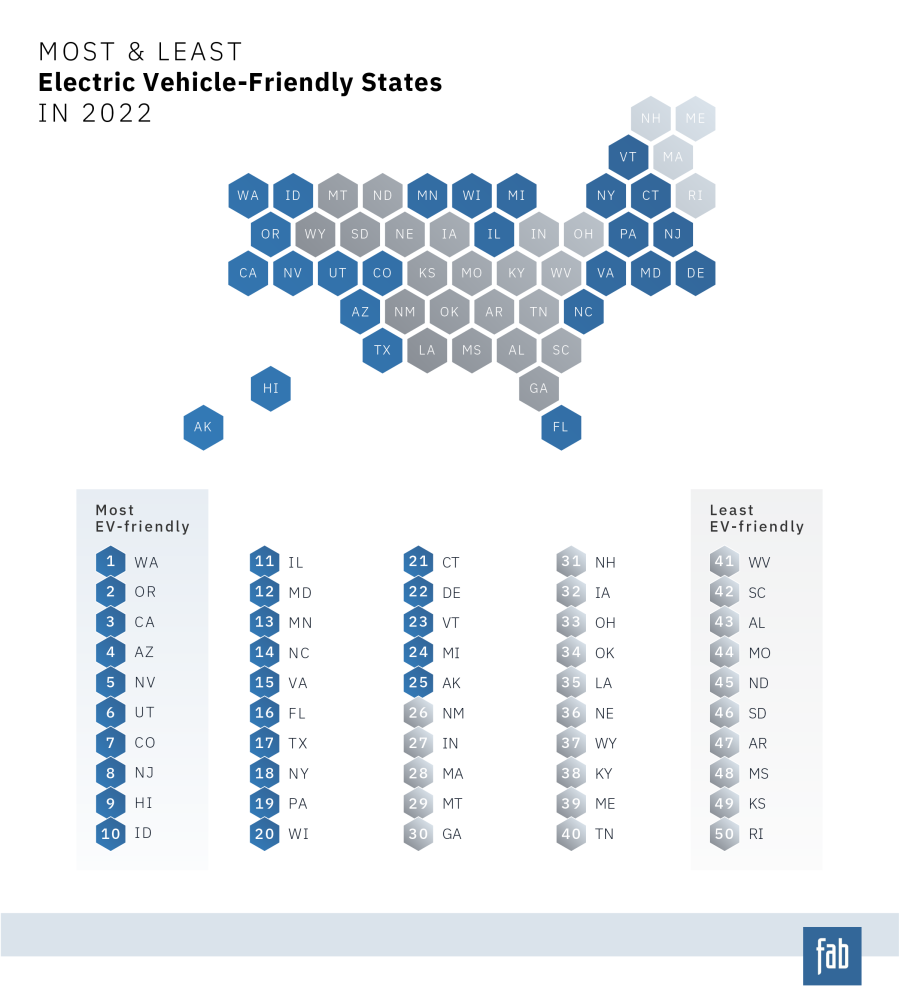

State-by-State Differences

While some states are quick to embrace electric vehicles, others are less favorable for potential buyers. In the second quarter, nine states and the District of Columbia had an electric vehicle market share greater than 10%, according to a report from the Alliance for Automotive Innovation. California leads the way, accounting for approximately a quarter of the market. The District of Columbia and Washington State follow closely, with market shares of 19.4% and 17.1%, respectively. In stark contrast, North Dakota lags with just a 1.2% market share.

The Influence of Politics

At the core of whether a state chooses to incentivize electric vehicle ownership are politics, according to Chris Harto, a senior policy analyst at Consumer Reports. He notes that the decision often comes down to the politics of individual states and their state legislatures. California is a prime example of a state with heightened interest in efficient vehicles.

According to Gil Tal, a professor at the University of California Davis and the director of the school’s Electric Vehicle Research Center, the Golden State has been a leader in electric vehicle adoption, with many advocating for government regulation to drive EV adoption.

Consumer Preferences and Incentives

A 2020 survey from Consumer Reports shed light on what factors would increase consumer interest in purchasing or leasing a plug-in electric vehicle. Thirty-four percent of respondents cited rebates at the time of purchase or lease, while 30% preferred rebates in the form of tax incentives. However, 42% indicated that the availability of public charging stations along highways was a critical factor, and 37% desired a discount on installing home charging stations.

Notably, discounted charging rates from utility providers were especially important to survey respondents. Efforts by utility providers to incentivize EV adoption have included offering rebates for home charging station installations. For instance, Great Lakes Energy, a Michigan utility cooperative, provides rebates of up to $800 for members who permanently install a Level 2 Smart Charger. Firelands Electric Cooperative in Ohio offers a $250 rebate to members who install a Level 2 charger at home.

Challenges and Skepticism

Despite the progress in promoting electric vehicles, there are still challenges to overcome. Eighteen percent of respondents in the Consumer Reports study indicated that none of the incentives in the survey, which included parking, HOV lane access, and charging-related incentives, would increase their interest in buying an electric vehicle. Additionally, a Yahoo Finance-Ipsos poll found that 57% of respondents were not likely to purchase an electric vehicle.

EV Models Eligible for Federal Credits

According to Consumer Reports, several EV models qualify for full federal credit. These vehicles meet requirements related to battery components and minerals, cost, and final assembly. Some eligible models include the Chevrolet Bolt, Bolt EUV, Blazer, Equinox, Silverado EV, Cadillac Lyriq, Ford F-150 Lightning, and Tesla Model 3, Model X, and Model Y.

On the other hand, models such as the Jeep Grand Cherokee 4xe PHEV, Ford Escape PHEV, Rivian R1S, and Rivian R1T may be eligible for a $3,750 credit. Tesla, which has recently announced price cuts, remains a popular choice among EV buyers, with one in three electric vehicles sold in the second quarter being a Tesla Model Y, according to Cox Automotive. Chevrolet models were the second most popular among electric vehicle sales.

The Impact of Electric Vehicles on Gas Taxes

To illustrate the impact of these fees, consider a Toyota Camry that drives 13,489 miles in a year (the average miles driven per year in 2021) and gets 29 miles per gallon. In Texas, this Camry would end up paying $93.03 in gas taxes annually, as calculated by Forbes. In contrast, a Ford F-150 that only gets 18 miles per gallon would pay $149.88 in gas taxes.

Texas’s fee for buying an electric vehicle is $200 per year, which is approximately double what one would pay in gasoline taxes for a conventional sedan. However, it’s only about 25% more than what someone might pay if they owned a gas-guzzling truck. Under Texas law, new EV owners must also pay a $400 first-time registration fee.

The Road Ahead

As the demand for electric vehicles continues to rise, dealerships and manufacturers are gearing up for substantial growth in the EV market. In the Bay Area, for instance, Jessie Dosanjh, who presides over about 20 car dealerships representing various brands, sees a significant opportunity as more electric vehicle models become available. With increasing demand and the continued introduction of new EV models, 2024 promises to bring even more volume to the electric vehicle market. Stay tuned for our best and worst states to buy evs in 2023 as the year ends and we gather more data.